British SMEs face uncertain funding future

Posted on in Business News , Cycles News , Creative News, Outdoor News, Political News

Thirty-five per cent of small businesses express concern over lack of funding options, and most don't know the options available to them.

SMEs in Britain are increasingly concerned about their ability to gain funding in the run up to Brexit, a recent survey reveals.

The study, commissioned by Hiscox, finds recent economic and political uncertainty has adversely affected business confidence, and caused concern for the future as Britain's withdrawal from the EU becomes nearer. This should come as no surprise, as 38% of the 500 businesses surveyed admit to accessing EU funding.

The study, commissioned by Hiscox, finds recent economic and political uncertainty has adversely affected business confidence, and caused concern for the future as Britain's withdrawal from the EU becomes nearer. This should come as no surprise, as 38% of the 500 businesses surveyed admit to accessing EU funding.

Despite the many funding options available to new businesses, 36% of business owners said a lack of choice was the most common single challenge they faced when looking for funding. 28% of businesses cited a lack of eligibility as the reason holding them back from obtaining finance and a further 25% said market competition was their key challenge.

More worryingly, what emerged from the survey was that one in five businesses was still unaware of the variety of funding options available to them, with most small businesses still turning to banks. Three-quarters of businesses surveyed said they used bank loans for funding over the last five years.

Finding the right solution for your business

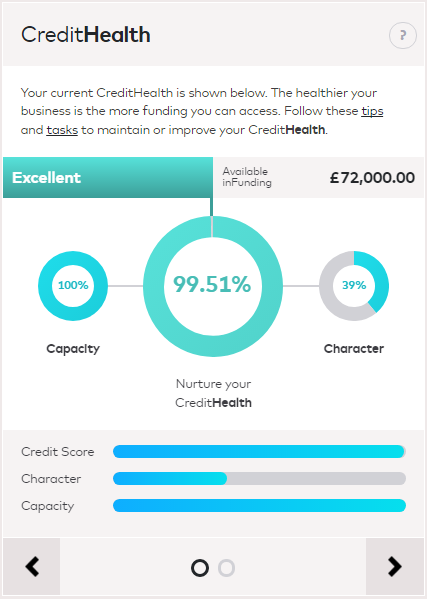

To help small businesses find the right funding for them, inFund allow you to view your Credit Health for free.

It takes just a few minutes to create a Credit Health report which shows you more than just your credit score. It is a live representation of where your business is today in respect of creditworthiness and it comes with preapproved Credit Capacity - the maximum amount that could be made available to you as a business loan (from £3,500 to £150,000).

It takes just a few minutes to create a Credit Health report which shows you more than just your credit score. It is a live representation of where your business is today in respect of creditworthiness and it comes with preapproved Credit Capacity - the maximum amount that could be made available to you as a business loan (from £3,500 to £150,000).

Once you know how much your business could be able to borrow you have the peace of mind knowing that it's there whenever you might need it, and whatever you might need it for...

- Seasonal cash flow requirement

- Big VAT quarter

- Business refurbishment

- Web development

- EPOS investment

- Diversify & expand product ranges

- New business initiatives!

Set up your FREE infund account today to see what your businesses Credit Health looks like and to see how much you can borrow. Simply click the link below to create your inFund account.