SMEs are ignoring their credit score

Posted on in Business News , Cycles News , Creative News, Outdoor News

Almost half (44 per cent) of small- and medium-sized enterprises (SMEs) say they have never checked their credit score, new research shows.

The study, released on Monday, found that a further six per cent have not checked their score in the last year, while less than one in five (18 per cent) have checked the score in the last six months.

Credit scores are an integral part of establishing whether a business is likely to be able to access finance in the future. Whether you need funding now, or want to prepare for the likelihood of needing it in the future, it's important that you know how a lender will view your business from a financial perspective.

Short term loans shouldn't just be reserved for struggling businesses trying to stay afloat. Businesses often seek additional finance to help in a variety of situations, including:

Short term loans shouldn't just be reserved for struggling businesses trying to stay afloat. Businesses often seek additional finance to help in a variety of situations, including:

- Managing seasonal cashflow

- Expecting a big VAT quarter

- Refurbishment or business expansion

- Web development

- EPOS investment

- To diversify or expand product ranges

- Any other new business initiatives...

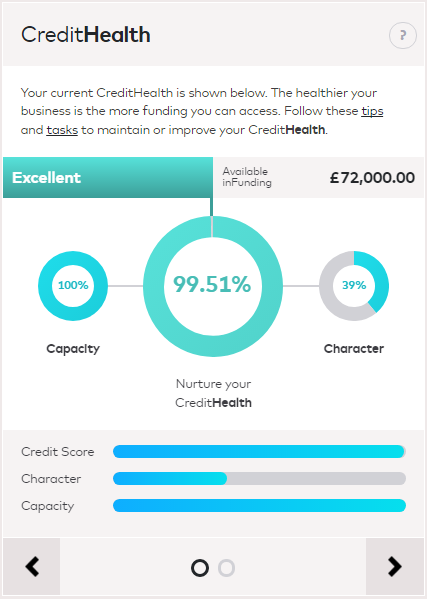

Don't wait until it's too late to find out how your businesses credit score looks. Start managing it today with inFund.

It takes just a few minutes to create your free inFund account and get a live representation of where your business is today in respect of creditworthiness and it comes with preapproved Credit Capacity - the maximum amount that could be made available to you as a business loan or line of credit with suppliers. This innovative approach of providing you with a Credit Capacity means that they'll never turn you down for finance.

Sole Traders or Partnerships should email info@infund.co.uk to register for their free health check.