ActSmart partner Tyl by NatWest leads the charge with new Tap to Pay

Posted on in Business News

Apple has announced that Tap to Pay on iPhone has now rolled out to the UK, enabling small businesses to accept Apple Pay and contactless card payments using nothing more than their iPhone.

Apple says that the feature is available now for businesses which use NatWest’s Tyl or Revolut as their payment processor, with more payment platforms coming soon.

The feature, which allows iPhone owners to accept payment without a separate card-reader, was first announced in February of last year, with a gradual rollout in the US through a growing range of payment processors.

The feature allows any modern iPhone to act as a payment terminal by utilising the NFC chip. Apple describes the feature as follows:

With Tap to Pay on iPhone, merchants can unlock contactless payment acceptance through a supporting iOS app on an iPhone Xs or later device running the latest iOS version. At checkout, the merchant will simply prompt the customer to hold their iPhone or Apple Watch to pay with Apple Pay, their contactless credit or debit card, or other digital wallet near the merchant’s iPhone, and the payment will be securely completed using NFC technology. No additional hardware is needed to accept contactless payments through Tap to Pay on iPhone.

“We’ve seen Tap to Pay on iPhone transform the checkout experience for so many different types of businesses, and we’re thrilled to now support merchants across the U.K. by offering an easy, secure, and private way to accept contactless payments using the power, security, and convenience of iPhone, with no additional hardware needed,” said Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet.

The feature works with almost all credit and debit cards.

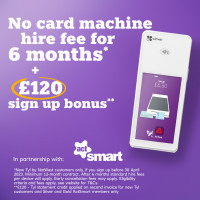

No card machine fees for 3 months and a £120 in credit when you sign up to Tyl by NatWest

ActSmart subscribers benefit from the following when they sign up to Tyl by NatWest.

- £120 sign up bonus*

- No card machine hire fees for the first 3 months

- Saving you money on transaction fees - reduced card transaction fees for businesses with less than £50k turnover from 1.65% to 1.5%

- 8 out of 10** businesses saved money on fees when switching to Tyl by NatWest

For more information visit our page here.

Tyl by NatWest terms, conditions, fees and eligibility criteria apply.

*For full terms & conditions click here.

Merchant offer is exclusively available to Silver and Gold ActSmart subscribers.

**Savings figure based on customers looking to switch from various providers to Tyl between Jan and March 2023. Your existing provider may charge an exit fee. Average savings not inclusive of introductory offers or any exit fees you may have been charged.