Can you access funds to help grow your business?

Posted on in Business News , Cycles News , Creative News, Outdoor News

Understanding your business's Credit Health is key to accessing the funds you need to grow your business.

Nearly half of UK SMEs say they have experienced barriers when looking for finance, with one in four SMEs being turned down when they applied.

One of the reasons so many small businesses are being turned down for finance is the level of risk that traditional lenders perceive. SMEs are less likely than bigger businesses to have the information required by traditional lenders (such as banks) to make an informed credit decision, including a lack of credit history or trading record.

One of the reasons so many small businesses are being turned down for finance is the level of risk that traditional lenders perceive. SMEs are less likely than bigger businesses to have the information required by traditional lenders (such as banks) to make an informed credit decision, including a lack of credit history or trading record.

Often, it can simply be down to the way these traditional lenders assess the creditworthiness of applicants.

The standard approach to credit assessment, as used by many traditional lenders, means that the information they look for is not there. This lack of information makes it difficult for the lender to assess the SME and subsequently offer finance. As a result, the lender's funds are usually driven towards larger and more established firms that better fit the credit assessment methods.

According to a report by the Department for Business, Innovation & Skills (BIS), 69% of SMEs have never checked their business and personal credit scores, with less than a fifth (17%) of SMEs saying they take active steps to manage their credit score. There will be a plethora of reasons for the 69% statistic, one of which will be perception that credit scores are not relevant to the way SMEs manage their business and cash flow. As such, credit scores are largely ignored by the SME sector.

SMEs need a credit assessment that really considers what they are doing and how their cash flow works. Whether you're a start-up looking for finance to get off the ground, or a growing company seeking funding for expansion, a lender using the right credit assessment method will look to build a picture of your circumstances to assess how much they can lend you.

With the right method of credit assessment, SMEs are much more likely to receive a score that opens their access to credit.

The right solution for your business

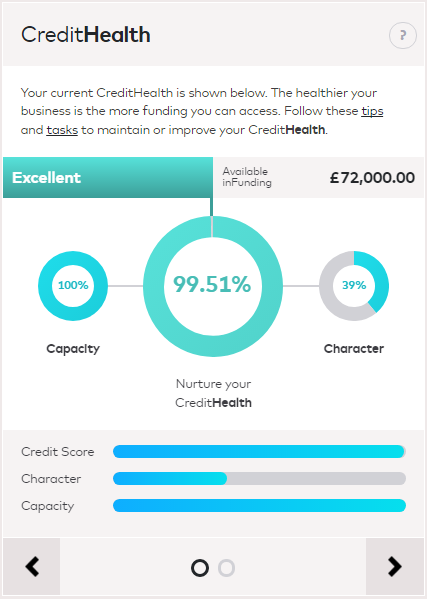

Until now there have been few options for SMEs to turn to when seeking business credit. However, the team behind inFund have turned that on its head and offer SMEs the chance to view their Credit Health for free. It takes just a few minutes to create and it is more than just a score, much more. It is a live representation of where your business is today in respect of creditworthiness and it comes with preapproved Credit Capacity - the maximum amount that could be made available to you as a business loan or line of credit with suppliers.

The inFund Credit Health is derived from current information rather than outdated accounts that you might have filed some months ago at Companies House. It considers your cash flow peaks and troughs allowing inFund to provide you with your Credit Capacity. Not only that, your Credit Health is an essential part of the inFund Credit Ecosystem providing you with useful insights into your business revenue and expenditure and the ability to monitor and nurture your Credit Health by keeping tabs on your critical sales/costs ratios, all from a simple dashboard. So not only do you benefit from a preapproved Credit Health, suppliers and distributors that also form part of the Credit Ecosystem can offer you lines of credit to purchase their goods too.

Don't wait until it's too late to find out if you could get the funding you need. Start managing your business's Credit Health today. With a free account you can have the peace of mind knowing that business credit is available to you as and when you need it. It costs you nothing yet is an essential tool to have on standby for the unexpected or to help you achieve your growth goals.

inFund's loans are very different to what's in the market and are convenient and affordable. Here is why:

- Access a truly flexible revolving credit solution: register and you will be assigned a Credit Capacity. This is the amount available to you in any monthly period that can be used in full or in part with access to the balance whenever you want it.

- Reduced interest rates. Up to 1.9% per month with the potential to access lower rates based on your Credit Health.

- Daily collections will make repayments painless and much more affordable, because they are aligned to your day to day cash flow.

- No red tape obligation - take funds today and, if you like, repay early with no early repayment fees.

- Sales improved this week? Make a lump sum repayment and reduce your outstanding balance - no additional costs, just savings.

Their innovative approach of providing you with a Credit Capacity means that they'll never turn you down for finance. The process does not leave any record on your business credit profile.

Click here to find out more and sign up to your FREE Credit Health report.