Retail finance workshop: The growth of online finance sales

Posted on in Cycles News

As more and more retailers become Ride it away dealers (now over 850 stores in the UK), it becomes increasingly important for every retailer to utilise this sales tool to its full potential. (And if you're not yet offering retail finance, you should be!) In the second of the retail finance workshops, ACT take a look at how incorporating finance into your website can really make a difference to your sales.

As more and more retailers become Ride it away dealers (now over 850 stores in the UK), it becomes increasingly important for every retailer to utilise this sales tool to its full potential. (And if you're not yet offering retail finance, you should be!) In the second of the retail finance workshops, ACT take a look at how incorporating finance into your website can really make a difference to your sales.

Reports suggest online retail sales are growing. With more than a fifth of UK retail sales taking place online in May for the fifth month in a row, it has never been more important to ensure your online offering is just as powerful as in-store.

In order to benefit from the growing number of customers heading online to make their purchase, retailers need to take the sales tools they have in-store and make them work online too.

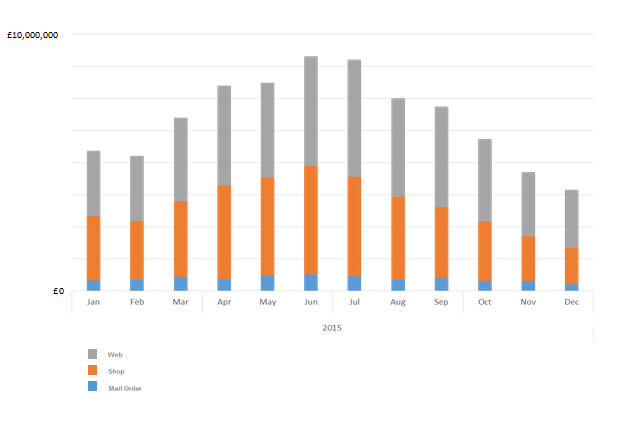

We know that retail finance is proven to boost sales, with 30% of customers spending more than they normally would have done had finance not been available - and this is just as true with online sales as in-store, if not more so. In fact, in 2015, 50% of all Ride it away sales were generated online, which highlights just how key these sales are to the growth of the scheme.

When shopping online the customer is left to make a decision about what to buy on their own, without the influence of retail staff or the retail surroundings.

In-store, retailers have the advantage of being able to draw the customer's attention to finance as soon as they enter with the use of in-store point of sale materials including window stickers, hanging banners and swing tags on bikes. They also benefit from having sales staff on hand to introduce finance early and discuss the different options available, allowing the customer to think about their monthly budget as opposed to the money they have available that day. This sales technique is proven to close more sales with 83% of customers stating that the availability of finance heavily influenced their decision to purchase from a specific retailer.

So, how can retailers take this successful in-store sales tool and make it work just as well online?

Using your website to promote the fact that finance is available in-store is great for driving more people into your shop, but what happens when the customer is ready to buy there and then? Integrating Ride it away into your e-commerce platform is a simple and low-cost solution.

Of course, one of the main advantages to integrating retail finance payment options online is the ability to be able to offer your customers finance 24/7. The finance application is completely automated with a quick to complete and simple to use online application form meaning a customer can get an instant decision and complete their purchase even when the shop is closed.

However, just having the option to pay on finance at the checkout isn't enough to boost sales. Typically by the time the customer is at the checkout, they've already made up their mind about what they are buying and have committed to making the purchase. So, in order to turn a browser into a buyer and encourage more products to be added to a basket, finance needs to be obvious as soon as the customer arrives at the site, and all throughout the browsing and purchasing process.

Make finance visible on your website using the FCA compliant Ride it away web banners, available in a variety of shapes and sizes to suit your website. There is also a finance calculator designed to make it easier for your customers to work out how much they can afford each month (web banners and finance calculator available to downaload for free from My ActSmart). Why not dedicate a page to Ride it away on your website to show customers just how simple and affordable it is?

To find out more about integrating finance into your website contact the ACT on 01273 427 700 or info@theact.org.uk. If you aren't already offering finance, visit www.rideitaway.biz to find out more or contact us to get set up today.